The reproduction cost analysis method is also called the asset-based approach. Reproduction cost analysis looks at what it would cost to rebuild the business or start a competing business in the same position. Reproduction cost analysis is useful for competitors seeking to buy a company. However, it is also helpful for startups or companies when there is not enough comparable data. This process can be done internally by analyzing the costs associated with starting your company. This makes it more appealing to private companies.

Additionally, reproduction analysis is very attractive to business owners because there is no need to look at outside data. Furthermore, it is simple to calculate because there are no complicated equations. Reproduction cost analysis can be calculated using just your company’s balance sheet.

Our previous article discussed this type of valuation method generally. However, this article will go into detail on this method and the process of how it is calculated. Then, we will finish with a real-world example of how to execute reproduction cost analysis.

Pros and Cons

This type of business valuation method is valuable to private companies because it can be done using information readily available to your company. Reproduction cost analysis is also easier for new or inexperienced business owners to calculate and understand. Furthermore, reproduction cost analysis takes into account a company’s goodwill.

Goodwill can be intangible assets that make up the business. Calculating a company’s goodwill puts a value on the company’s reputation, customer loyalty or intellectual property. The major setback to reproduction cost analysis is that it does not consider a company’s prospective earnings.

Prospective earnings could be a significant selling point to some companies therefore it is crucial to keep that in mind when choosing this type of valuation method.

Process

Now we will go into how to calculate reproduction cost analysis. Reproduction cost analysis is based on the net asset value of a company. This is what we will be solving for in our equation. Net asset value is calculated by subtracting the total liabilities from the total assets of a company. Furthermore, this valuation method is normally adjusted based on the market value of its assets and liabilities.

The value of your business using the reproduction cost method all the assets and liabilities of a business are compiled and a value is assigned to each one. The value of your business is the difference between the value of the assets and liabilities. Therefore, first you need to gather all the related information to create your balance sheet. Once you have your balance sheet together you can subtract your liabilities from your assets. This gives you the total value of your business.

Example

Now we are going to go through a real world example of this type of business valuation. Reproduction cost analysis is simple once you have all the relevant data pertaining to your business. In this example, the names and information has been changed to protect their privacy.

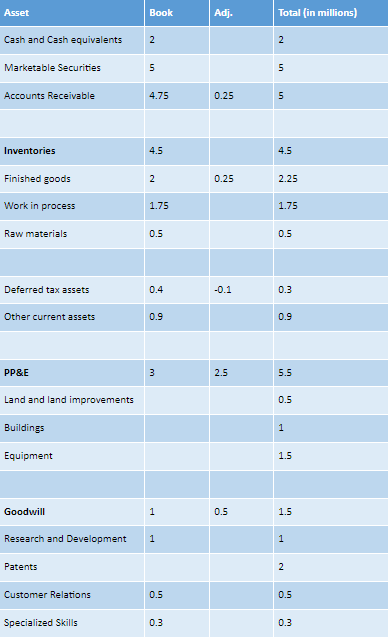

Scott’s Scooters makes motorized scooters and they have been developing a patented scooter that is able to fold compactly and become portable. They are a new start up company with a patented design. This makes them the perfect candidate for reproduction cost analysis. Scott’s Scooters wants to determine the value of their business because another company has shown interest in their product. They think this information will be helpful if they want to get acquired in the future. The first step is for Scott’s Scooters to gather all the relevant information about their company. Once Scott’s Scooters gets all the relevant information together, they can create a balance sheet. Here is an example of what that balance sheet looks like.

When gathering all the information for the balance sheet it is important to keep everything organized. Here, in bold we have the different categories for different types of assets. This will help you in the long run if you need to adjust the information. In this balance sheet the numbers are in millions. Your business does not have to do it this way since the numbers are not exact. However, if you are working with larger numbers rounding up or down helps to streamline the balance sheet. The liabilities are in the Adj. section and are subtracted from the assets. In this case, Scott’s Scooters total value is $36 million.

Scott’s Scooters will be able use this information when making future business decisions. Now that they know the value of their company they can negotiate smarter and more efficiently. Furthermore, they can use this information to strategize ways to increase the value of their company.

Reproductive cost analysis is attractive because it takes into consideration all the assets that your company has worked hard to acquire. However, it is important to be realistic when assigning values to your company’s assets. Keep in mind that this information is for your gain. Therefore, it is crucial to keep in mind when executing this type of analysis. Business owners who can confidently walk into negotiations knowing the value of their business will be able to make intelligent business decisions. This information can also be turned into a working document. This means you can add or take from it as your business grows. Using a working document will have you prepared for any negotiation or transaction at any time. Additionally, a prepared business owner is more likely to make intelligent business decisions, which is imperative when determining your company's future.

[1].2007091346040.jpg)