What Is Comparable Companies Analysis?

Comparable companies analysis is a type of business valuation method that determines the value of your company by looking at the ratios of similar companies. Comparable companies analysis is established by determining your company’s relative positioning among peer companies.

In our previous article, we discussed the multiple different types of business valuation methods and provided a high-level analysis of those methodologies. This article is going to discuss comparable companies' analysis in more detail and provide steps on how to perform this type of analysis. We will also go through a real-world example of how to execute comparable companies analysis.

Call (813) 331-5056 now or contact our firm online to get started with an experienced business law attorney.

Comparable companies analysis is easy to calculate and uses widely available data. However, it can be less useful when there are few or no comparable companies. Furthermore, it can be less reliable if the companies are not traded very often.

Therefore, it is important to find as many comparable companies that are widely traded. This process is easier for public companies because their information is public. However, it is not impossible for private companies to perform this type of analysis if they have enough data. There are four steps to comparable companies analysis that we are going to walk through.

Step 1: Create Your Universe

This first step is the most important and can take you some time if you are doing it on your own. First, you need to create a broad list of comparable companies.

This list can be refined later, however, creating a large universe, in the beginning, provides more comparable data and saves you time in the long run. Look for companies of similar:

- Size

- Profitability

- Growth profile

- ROI

- Industry

- Geographic location

Finding this information takes time, however, sites like CapIQ and Bloomberg can provide this data.

Step 2: Collect Necessary Financial Information

After you’ve created a list of all the comparable companies, you can start finding the financial information needed. This information can also be found on Bloomberg and Capital IQ’s websites.

However, their sites charge fees for this information. A free way to find this information is to search through the company’s SEC filings, press releases, or equity reports. Search for information pertaining to the company’s gross profit, revenue, EBITDA, and EPS.

Step 3: Create a Spreadsheet

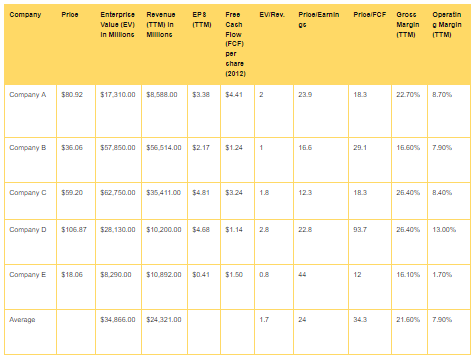

The third step is to take all the information you have gathered and put it into a table or spreadsheet. In your table make sure you have the company name, market capitalization, net debt, enterprise value, revenue, EBITDA, EPS, and IBES estimates.

It is important to keep all your data organized. Furthermore, try to stick to more recent data, because the market conditions will affect the transactional data.

Step 4: Benchmarking

The fourth and final step is to calculate the comparable ratios and compare the comparable companies to one another and to your company. The ratios to determine are: EV/sales, EV/EBITDA and P/E.

EV: stands for enterprise value. Here is the formula:

EV = market capitalization + Debt + Preferred Stock + Minority interest - Cash

EV/Sales: is the enterprise value of the company divided by the sales

EV/EBITDA: is the enterprise value divided by the EBITDA

P/E is the price-earnings ratio. This is calculated as share price divided by the book value per share (or market capitalization) divided by the shareholders’ equity

Comparable Company Analysis Example:

Now we are going to go through a real-world example of when to use comparable company analysis. The names and information have been changed to protect their privacy.

Barry’s Bagels is a public company. They are looking to sell their business in five years and want to determine the value of their company. They are looking to use this information to create a benchmark valuation and use that information to boost their company’s value before they are sold.

First, Barry’s Bagels is going to look for other bagel or food companies that are similar to their own. Next, they are going to gather all the necessary financial information from these companies.

Barry’s Bagels found this information through Bloomberg, various press releases, and SEC filings. After gathering all the information on the comparable companies, Barry’s Bagels creates a spreadsheet that looks like this:

Once the average is calculated, Barry’s Bagels can use that average to determine the value of Barry’s Bagels. Now, Barry’s Bagels can use this information to increase the value of their company and get a fair price for their business.

This information is key for future negotiations. Now, Barry’s Bagels is prepared to make an educated business decision. Furthermore, now they have time to increase the value of their business before they start negotiating.

Educated business owners make educated business decisions. The value of your business is key to smooth and efficient business transactions.

However, comparable companies analysis centers around finding comparable data to determine the value of your business. This is why it is easier for public companies to use comparable companies analysis.

When executing comparable companies analysis, keep in mind: more data means a more reliable business valuation.

Get started on your case with our Tampa business law attorneys. Call (813) 331-5056 now or fill out our online contact form today!